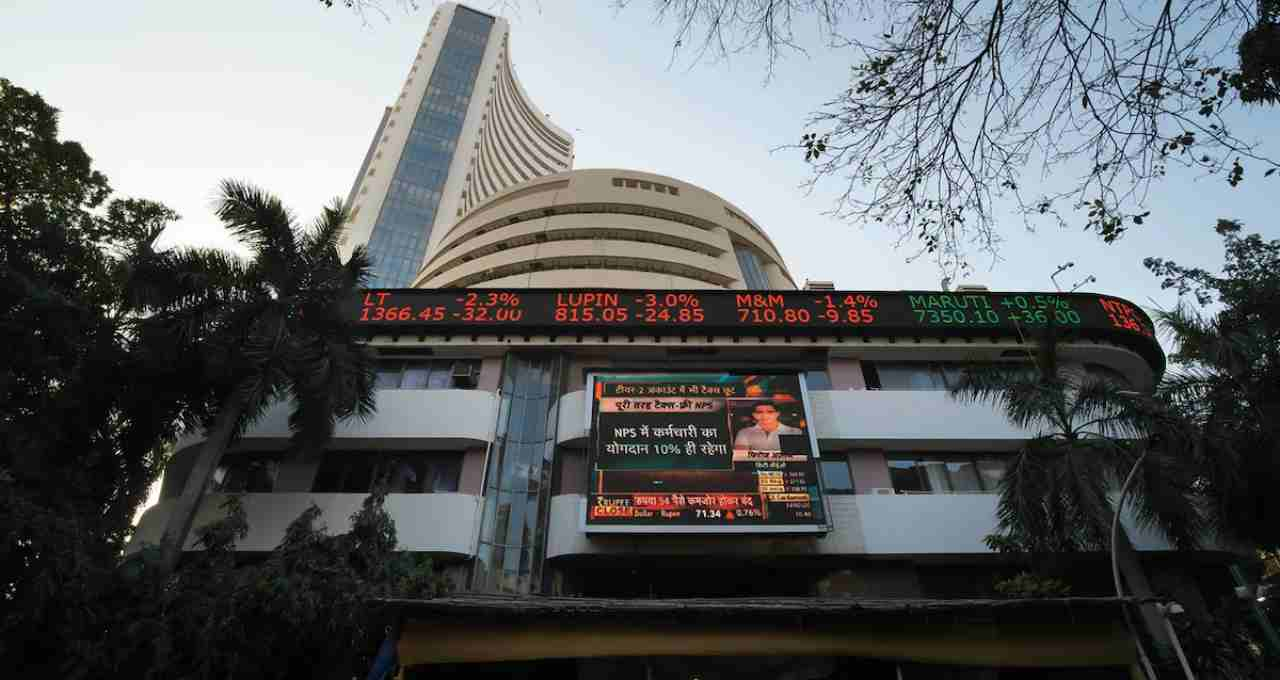

Pakistan's economic situation has been deteriorating rapidly, further exacerbated by the terrorist attack in Pulwama, Jammu and Kashmir, on April 22nd. India's response, codenamed "Operation Sundar," targeting terrorist bases in Pakistan, resulted in a significant downturn in the Pakistani stock market.

Pakistan Stock Market: The impact of India's Operation Sundar, launched in response to the Pulwama attack, was clearly visible on both Indian and Pakistani stock markets. While the Indian stock market reacted positively, showing gains, the Pakistani stock market reflected deep concern and a bearish trend.

Following the Indian strikes on terrorist bases in Pakistan on Wednesday, Pakistan's benchmark stock index (KSE-100) plummeted by 5.78 percent. In early trading, the KSE-100 index showed a decline of 6,272 points, approximately 5.5 percent, trading at 107,296.

Sharp Decline in Pakistan's Stock Market

Operation Sundar severely impacted the Pakistani stock market. After April 23rd, a significant collapse was observed. On April 24th, the KSE-100, Pakistan's benchmark stock index, recorded a sharp decline of 5.78 percent. The index fell by 6,272 points, reaching 107,296. This decline has had a profound effect on Pakistan's economic structure, creating a climate of fear among investors.

Following the Pulwama attack on April 22nd, India announced the termination of trade relations with Pakistan. This has had a severe impact on Pakistan's economy. Further actions by India, such as considering the revocation of the Indus Waters Treaty, reducing diplomatic staff, and cancelling SAARC visa relaxations, have weakened Pakistan's position even further. Consequently, investors have lost billions of rupees in the Pakistani stock market.

Crisis at the Karachi Stock Exchange

On April 24th, the KSE-100 index at the Karachi Stock Exchange suffered another major blow. Within minutes of the market opening, the index plummeted by 2,485 points. Simultaneously, Pakistan's stock market capital market also experienced significant losses. While the Karachi Stock Exchange's market cap was previously $52.84 billion, by April 29th, it had fallen to $50.39 billion.

Since April 22nd, Pakistan's stock market has seen a decline of 5,494.78 points, or approximately 4.63 percent. This has caused significant economic damage to Pakistan. Within a few days, the Pakistani stock market suffered losses of $2.45 billion. This has further aggravated Pakistan's already weak economic condition. Already struggling with an economic crisis, Pakistan now faces this new challenge.

Inflation in Pakistan is also continuously rising. In May 2023, the inflation rate reached 38.5 percent, signaling a serious crisis for Pakistan. Furthermore, Pakistan's foreign exchange reserves have fallen below $3.7 billion, another cause for concern. Consequently, Pakistan's economic situation has become even more precarious, and the country's financial crisis has stalled economic growth.