The number of investors in the share market is rapidly increasing, but so are cases of fraud and deception. Market regulator SEBI warned investors on Wednesday that some fraudsters are misleading the public by sending fake notices and documents in its name.

Business: The number of investors in the share market is rapidly increasing, but simultaneously, cases of fraud and deception are also emerging. These days, some fraudsters are misleading investors by sending fake notices and documents in the name of the Securities and Exchange Board of India (SEBI). SEBI itself has revealed this and warned investors to remain vigilant.

Modus Operandi of Scams in SEBI's Name

SEBI has stated that some fraudsters are misusing its official logo, letterhead, and seal to send fraudulent documents. In these, the fraudsters claim to be purchasers of assets like PACL and that their notices have been issued by SEBI. Furthermore, these fake notices also provide bank account numbers that are falsely presented as being approved by SEBI.

Such notices are often sent through social media, phone calls, emails, and messages. These notices pressure investors by threatening them with penalties or demanding acceptance of property claims. These notices are entirely fake, and SEBI has no connection with them.

How to Identify Fake Notices?

SEBI has provided several important suggestions to caution investors and help them identify fake notices and documents.

- Pay attention to the official email address: All emails sent by SEBI originate only from the @sebi.gov.in domain. If you receive an email from any other domain, consider it fake and do not trust it.

- Do not share personal information: If any email, phone call, or message asks for your bank details, passwords, or any sensitive information, be cautious. SEBI never directly requests such information from investors.

- Check the UDIN number: Genuine SEBI documents have a Unique Document Identification Number (UDIN). This can be verified by visiting the official SEBI website. If the notice does not have a UDIN number or it cannot be verified, the notice is fake.

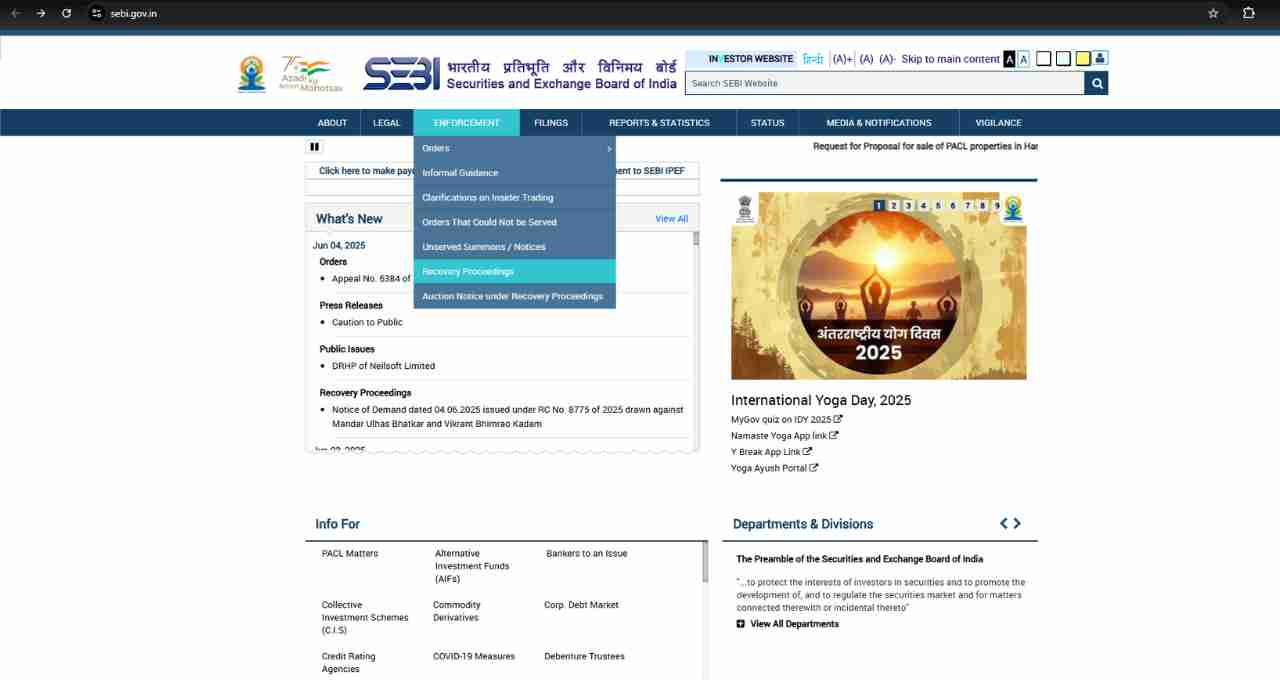

- Check with the official SEBI website: Upon receiving any notice, verify its validity at www.sebi.gov.in. Specifically, you can confirm the notice under ‘Orders’ and ‘Recovery Proceedings’ available in the Enforcement section.

- Contact SEBI directory: If you have received a notice from SEBI, you can confirm its authenticity by contacting the officials listed in the SEBI directory.

Increasing Scams through Social Media and Calls

Nowadays, fraudsters are also extensively using social media platforms and phone calls. They pose as SEBI officials and send notices to investors. Sometimes, these calls seem so genuine that many investors panic and quickly send the requested amount. Therefore, investors should always remain calm and first verify the validity of the notice.

Important Advice from SEBI to Investors

- Do not immediately ignore any unfamiliar or suspicious notice, email, or call; instead, investigate it.

- Verify the notice on the official SEBI website.

- Do not share your bank and other financial details with anyone.

- If you suspect a notice is fake, you can file a complaint with SEBI's helpline number or email address.

- Inform your acquaintances about any fraudulent calls or messages so that they can also remain vigilant.

SEBI continuously monitors such fraudulent cases and takes strict action. It is implementing technological improvements and running awareness campaigns to prevent fraud. Furthermore, SEBI has repeatedly issued public warnings to not ignore any suspicious activity claiming to be from them.