America's National Debt Surpasses $36 Trillion: An Economic Tsunami?

America: America's national debt has soared past $36 trillion, representing 122 percent of the country's GDP. This poses a significant challenge not only to the American economy but also to the global financial system. Elon Musk, the renowned industrialist and CEO of Tesla, has expressed deep concern regarding this escalating debt.

He has labeled the debt surge an "economic tsunami" and referred to Donald Trump's recently proposed tax bill as a "Debt Slavery Bill." Musk believes this bill will further exacerbate America's debt burden, pushing the country towards severe economic challenges, including recession, inflation, and a potential liquidity crisis.

The Severity of America's Debt

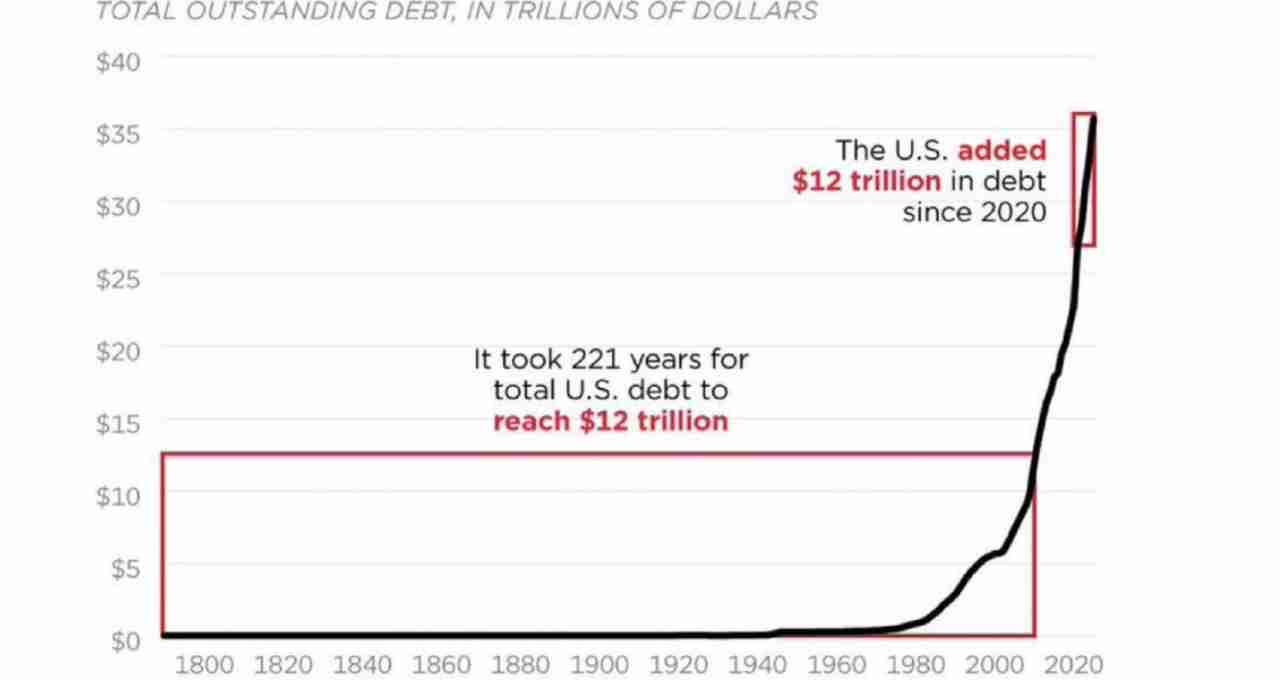

Comprehending the magnitude of America's $36 trillion debt can be daunting. To illustrate, India's current GDP is approximately $4.19 trillion. Therefore, America's debt is roughly eight times the size of India's entire economy. This debt encompasses not only the federal government's annual expenditures but also substantial interest payments.

The national debt represents the total amount borrowed by the U.S. federal government through various financial instruments, such as Treasury bonds and notes. This borrowing becomes necessary when government spending exceeds its revenue. It's a trap that makes achieving sustainable economic growth extremely difficult.

Elon Musk's Grave Warning about the Debt

Elon Musk recently criticized Trump's tax bill, stating that it could further entrench America in a debt trap. Musk labeled the bill a "Debt Slavery Bill," implying it would lead to economic subjugation. He projected a potential $2.5 trillion increase in the national debt due to this bill.

Musk posted on social media that if the bill passes, a significant portion of the government's revenue would be consumed by interest payments alone, leading to a shortage of funds for crucial government expenditures such as healthcare, social security, and defense. He urged the American public to advocate for spending cuts and for the government to operate within its means.

Global Impact of the American Debt Crisis

America's precarious economic situation is not isolated. It could have severe global repercussions. Developing nations like India will be affected. Negative impacts are expected on export sectors, while opportunities might arise in other areas.

Trump's tariff policies have fueled inflation. Rising prices of imported goods exacerbate inflationary pressures, impacting consumers' budgets. Musk contends that if America fails to control its debt and budget deficit, the risk of a recession will significantly increase.

Depth of the Debt Crisis and Future Concerns

According to financial experts, if current trends persist, the American debt could reach 140 percent of GDP by 2035. This means the debt burden would far exceed the nation's productive capacity.

America incurs substantial and escalating annual interest payments on its debt. In 2023 alone, interest payments exceeded $1 trillion. Rising interest rates will amplify this burden, negatively affecting government spending on social programs and defense.

Foreign investors are divesting from U.S. bonds, causing market instability and raising concerns about a liquidity crisis. Musk warns that this financial situation could push America toward default—an inability to repay its debts.

Warnings from Financial Titans

Key players in the American financial market are taking this situation seriously. Jamie Dimon, CEO of JPMorgan Chase, has urged immediate control over government spending. Hedge fund manager Ray Dalio has warned that a decline in confidence in the U.S. financial system could trigger a severe debt crisis.

The Council on Foreign Relations projects that without structural reforms, the national debt could double within the next thirty years. This would severely limit government investment in defense, infrastructure, and social programs.

Keynesian Theory and American Reality

The renowned economist John Maynard Keynes famously stated that if you owe your bank a hundred pounds, you have a problem; but if you owe your bank a million pounds, it has a problem. America's situation mirrors this, with its debt far exceeding its income.

Keynes argued that borrowing is justifiable only within one's capacity. Excessive debt leads to financial instability and economic crises. This is the precise challenge facing America, one that requires urgent attention.