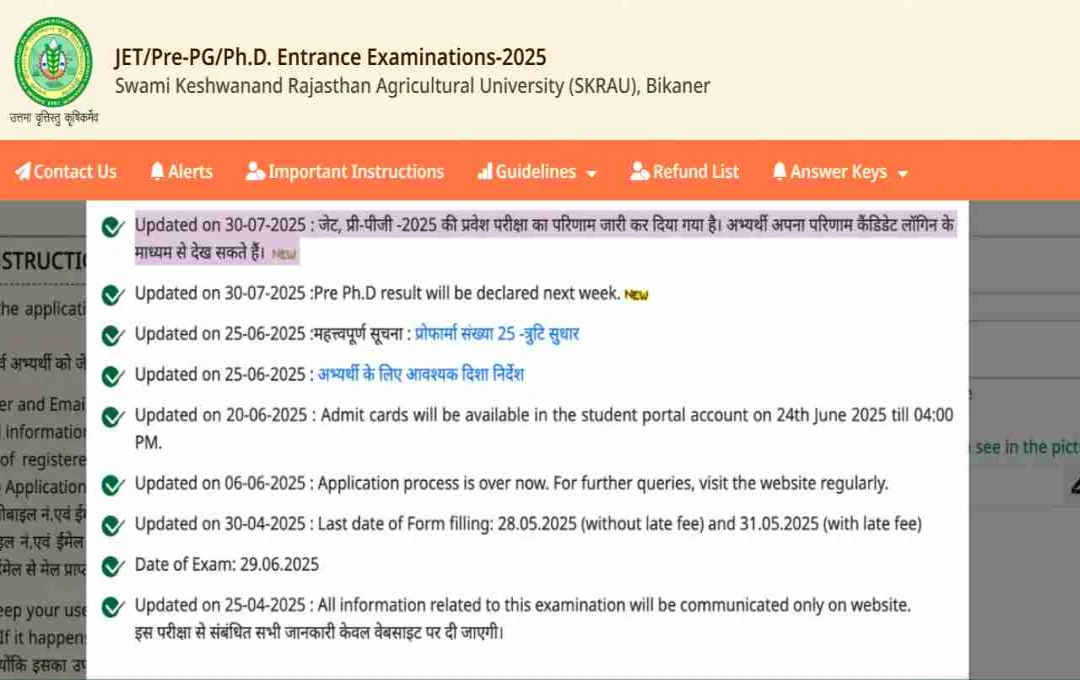

The Interest Equalisation Scheme, launched in 2015 to boost exports, was discontinued in December 2024. Since then, exporters have consistently demanded its revival. Now, considering the changing global landscape, increased tariffs from the US, and uncertainties in the international market, the central government is again considering reviving the scheme.

New Delhi: The Interest Equalisation Scheme may be relaunched to provide relief to small and medium-sized exporters. The government is considering reimplementing the scheme, which was discontinued in December 2024.

This move may be prompted by the US increasing tariffs on imports and the prevailing global economic uncertainty. This scheme would enable MSME exporters to access loans at cheaper interest rates.

Currently, Indian exporters obtain loans from banks at an average interest rate of 8% to 12%. This rate often becomes even higher for MSME units, increasing their costs. In contrast, entrepreneurs in countries like China access loans at a mere 2% to 3% interest rate. This is why it becomes challenging for Indian MSMEs to maintain competitiveness in the global market.

Affordable Funding Crucial for Export Growth

India recently signed a Free Trade Agreement (FTA) with England, and negotiations are underway with the US. MSME exporters believe that financial incentives are necessary to fully leverage these global opportunities.

Consequently, exporters have repeatedly urged the government to reintroduce the Interest Equalisation Scheme. When the budget made no mention of extending the scheme, exporter organizations requested Finance Minister Nirmala Sitharaman to intervene separately on this issue.

Ashwini Kumar, the then-president of FIEO (Federation of Indian Export Organisations), advocated for the scheme's reimplementation, stating that Indian MSMEs receive loans at higher interest rates compared to China, hindering their global competitiveness.

He also demanded an increase in the credit limit—suggesting a rise from the current ₹50 lakh per company to ₹10 crore. He argued that limited subsidies are making many small exporters hesitant to accept new orders.

What is the Interest Subsidy Scheme?

The Interest Equalisation Scheme was launched in 2015 to promote exports and provide affordable financing to the MSME sector. Initially implemented until March 31, 2020, it was extended several times due to its positive impact. The last extension was in September 2023, lasting until December 2024.

Under this scheme, exporters received a 3% subsidy on the interest on export credit in rupees for pre-shipment and post-shipment financing. According to data, approximately 80% of the total beneficiaries of this scheme were from the MSME sector.

It was monitored by the Directorate General of Foreign Trade (DGFT) and the Reserve Bank of India (RBI). It was considered a crucial part of the government's Export Promotion Policy, helping small and medium-sized enterprises remain globally competitive.

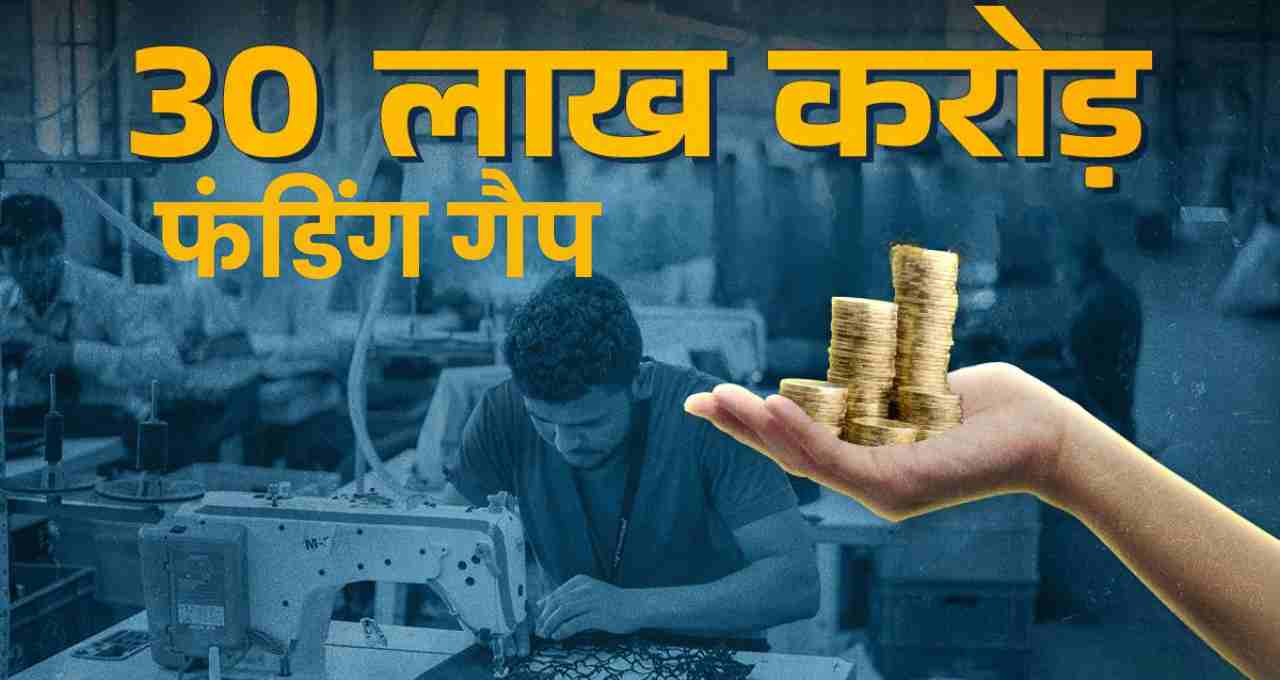

A Funding Gap of ₹30 Lakh Crore

According to a recent report by the Small Industries Development Bank of India (SIDBI), the country's MSME sector receives approximately 24% less credit than its actual requirement. This credit gap is about ₹30 lakh crore, highlighting the sector's financial challenges.

In the SIDBI survey, 22% of the enterprises cited the unavailability of credit as the biggest hurdle. This clearly shows that financing remains a major impediment to MSME growth.

According to government figures, under the Annual Survey of Unincorporated Sector Enterprises for 2023-24, there are 7.34 crore MSME units in the country. Of these, 98.64% are micro, 1.24% are small, and only 0.12% are medium enterprises.

MSME Sector: The Backbone of the Indian Economy

The role of Micro, Small, and Medium Enterprises (MSMEs) in India's economy is continuously strengthening. According to a SIDBI report, the MSME contribution to the country's Gross Value Added (GVA) was 27.3% in 2020-21, increasing to 29.6% in 2021-22 and reaching 30.1% in 2022-23.

The MSME sector has made rapid progress not only in the domestic market but also in exports. While exports from these units were ₹3.95 lakh crore in 2020-21, they are projected to reach ₹12.39 lakh crore in 2024-25—reflecting the sector's growing presence in the international market.

The number of exporting MSMEs has also increased rapidly—from 52,849 units in 2020-21 to 1,73,350 by May 2024.

The sector's contribution to India's total exports has also steadily increased:

- 2022-23: 43.59%

- 2023-24: 45.73%

- 2024-25: 45.79%

The government has also taken steps to boost MSME exports. In the 2025-26 budget, the loan limit for MSME exporters under the credit guarantee scheme has been increased to ₹20 crore.