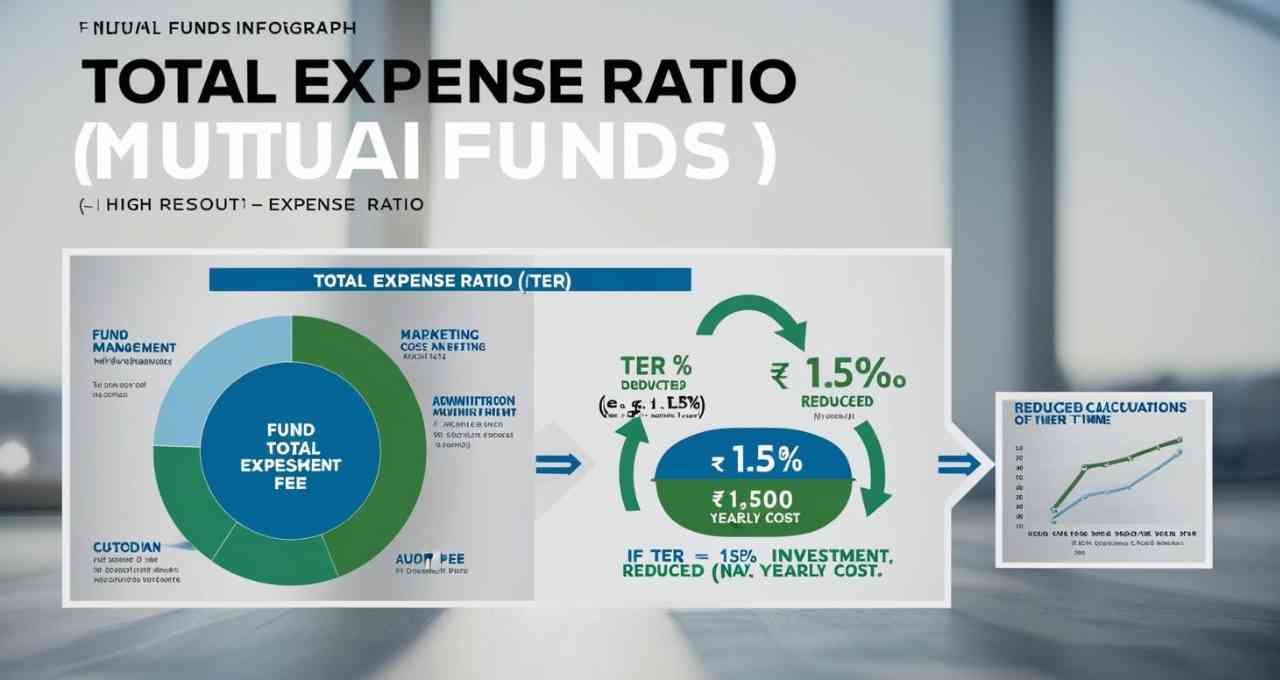

Before investing in mutual funds, most people focus solely on returns, overlooking associated expenses. This often leads to lower-than-expected returns. Fund houses charge fees to manage mutual fund schemes; this is known as the Total Expense Ratio (TER). Understanding TER is crucial as it directly impacts your returns.

What is Total Expense Ratio (TER)?

The Total Expense Ratio (TER) is the fee or expense a fund house charges to manage a mutual fund scheme. This includes costs such as fund management, marketing, administrative expenses, transaction fees, custodian fees, and audit fees. This total expense is deducted from your mutual fund's Net Asset Value (NAV).

TER is expressed as a percentage. For example, if a fund's TER is 1.5%, it means 1.5% of your invested amount will be deducted annually as operating expenses.

How is TER Calculated?

TER is calculated using a specific formula:

TER = (Total Fund Expenses / Total Fund Net Assets) × 100

This percentage indicates the proportion of your total investment deducted as expenses. In India, SEBI has set a limit on TER to protect investor interests. However, this percentage can vary across different funds.

Does a High TER Indicate Poor Performance?

A higher TER doesn't automatically mean a fund is bad or should be avoided. Sometimes, funds with higher TERs can provide better returns. Conversely, some funds with lower TERs may exhibit average performance. Therefore, investment decisions shouldn't be solely based on TER.

What to Consider When Investing?

- If two funds have similar performance and risk profiles, choosing the one with a lower TER might be wiser.

- Understand the fund's objective and strategy.

- Consider the fund manager's experience and past performance.