India's largest public sector bank, the State Bank of India (SBI), has once again demonstrated its financial strength by paying a dividend of ₹8,076.84 crore to the central government for the fiscal year 2024-25.

Stock Market: SBI, a leading public sector bank in India, has taken another step to bolster the government's finances. The bank has paid a dividend of ₹8,076.84 crore to the government for the fiscal year 2024-25, approximately 16% higher than the previous year. This not only strengthens the government's treasury but also indicates the stability and growth of the Indian banking sector.

This report will detail the significance of this dividend, its benefits to the government, the bank's current financial standing, and its implications for investors.

Record Profit, Record Dividend

The State Bank of India recorded a record profit of ₹70,901 crore in 2024-25. This is a 16% increase compared to the profit of ₹61,077 crore in the previous fiscal year (2023-24). This outstanding performance led the bank to decide on a substantial return for its shareholders, with the government holding the largest stake.

Comparison with the Previous Year

Fiscal Year Total Profit (₹ crore) Dividend to Government (₹ crore)

2023-24 61,077 6,959.29

2024-25 70,901 8,076.84

What Does Dividend Mean?

A dividend is the portion of a company's profit distributed to its shareholders. Since the government is SBI's largest shareholder, it received the largest share of the dividend. This time, SBI declared a dividend of ₹15.90 per share, higher than the previous year's ₹13.70 per share. This directly benefited the government, along with other SBI shareholders.

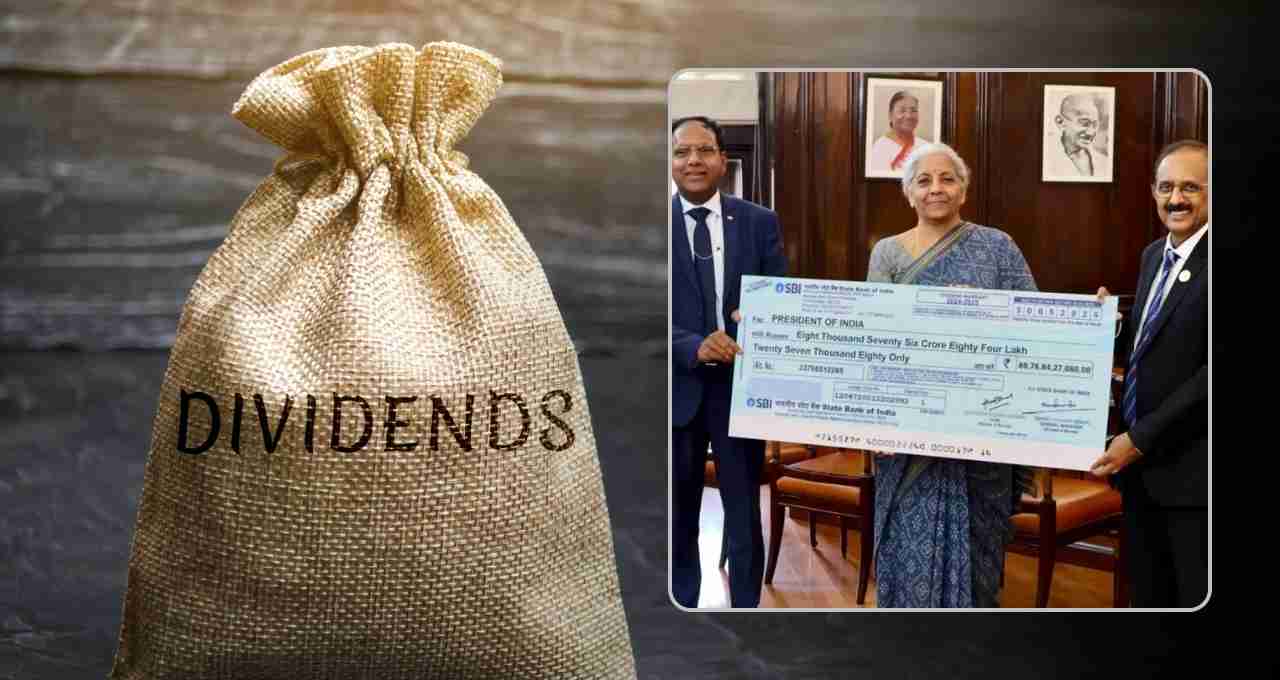

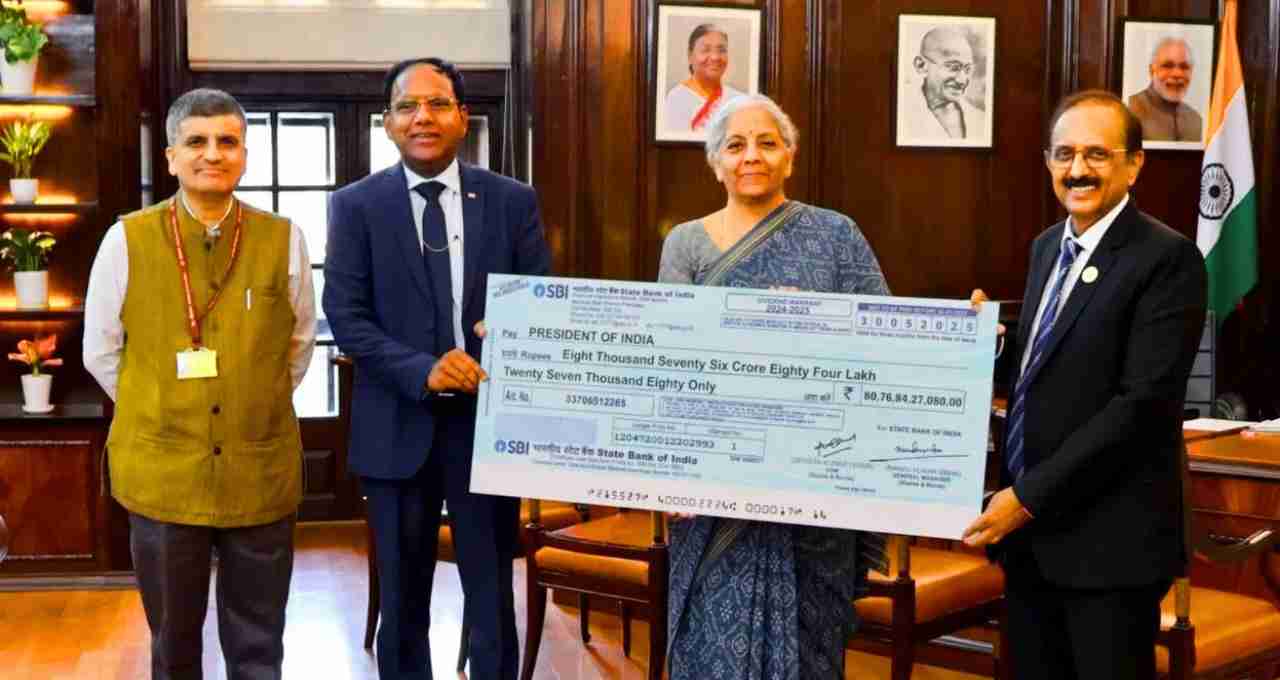

Cheque Presented to the Finance Minister

SBI Chairman C.S. Setty personally presented the dividend cheque to the Union Finance Minister, Nirmala Sitharaman. Financial Services Secretary M. Nagaraju and Finance Secretary Ajay Seth were also present. This was not merely a formal transaction but also symbolized the b cooperation and mutual trust between the government and public sector banks.

The government shared this news on the social media platform X (formerly Twitter), highlighting the substantial amount transferred to the government's account by SBI.

Shareholding in SBI

SBI is a public sector bank, with the government holding the largest share.

- Government of India: 57.42%

- LIC (Life Insurance Corporation of India): 9.02%

- Other Public Shareholders: Remaining shares

LIC, a government-owned company, is the largest non-promoter shareholder in the bank. This signifies that government agencies are the primary beneficiaries of the bank's success.

SBI Share Performance

SBI shares have also performed well in the stock market.

- BSE Closing Price (June 10, 2025): ₹820.05

- 52-Week High: ₹898.80

- 52-Week Low: ₹679.65

This performance clearly indicates investor confidence in SBI. The increase in dividends is likely to further attract investors, potentially increasing both demand and share price.

Significance for the Indian Economy

SBI's increased profits and the dividend paid to the government convey several key economic messages:

- Increased Government Revenue: The ₹8,076 crore dividend received by the government will help reduce its fiscal deficit.

- Strengthening of the Banking Sector: The b performance of the country's largest public sector bank positively impacts the overall credibility and stability of the banking system. This boosts confidence in other banks and strengthens the financial system as a whole.

- Government Company Earnings: This demonstrates that well-managed government-controlled institutions can generate profits and increase government revenue.

Investor Takeaways

- Investing in Dividend Stocks: Investors should consider investing in companies that consistently pay dividends. SBI is a prime example.

- Confidence in Government Companies: While investors sometimes avoid government companies, stocks like SBI demonstrate that these can also offer excellent returns.

- Importance of Long-Term Holding: SBI shares have been stable and reliable over the past 5 years. Long-term holding can yield significant profits.