Four of the top ten most valuable companies on the Sensex experienced a combined market capitalization increase of ₹101,369.5 crore. Life Insurance Corporation of India (LIC) recorded the highest gains during this period.

Business: The Indian stock market has witnessed significant fluctuations in recent weeks. The BSE Sensex's top 10 companies have presented mixed news for investors. While LIC delivered a substantial ₹59,233 crore profit to its investors in a week, giants like Reliance Industries and Tata Consultancy Services (TCS) saw their investors incur losses. Despite a slight dip in the Sensex this week, some companies maintained a b position, while others experienced a decline in value.

LIC Delivers Significant Gains to Investors

Last week, LIC's market capitalization increased by ₹59,233.61 crore, reaching ₹603,120.16 crore. This surge makes LIC the most profitable company among the Sensex's top performers. The company's b financial position and investor confidence are cited as the primary reasons behind this growth. LIC's leading role in the insurance sector and market stability have also fueled investor interest.

Other Profitable Companies

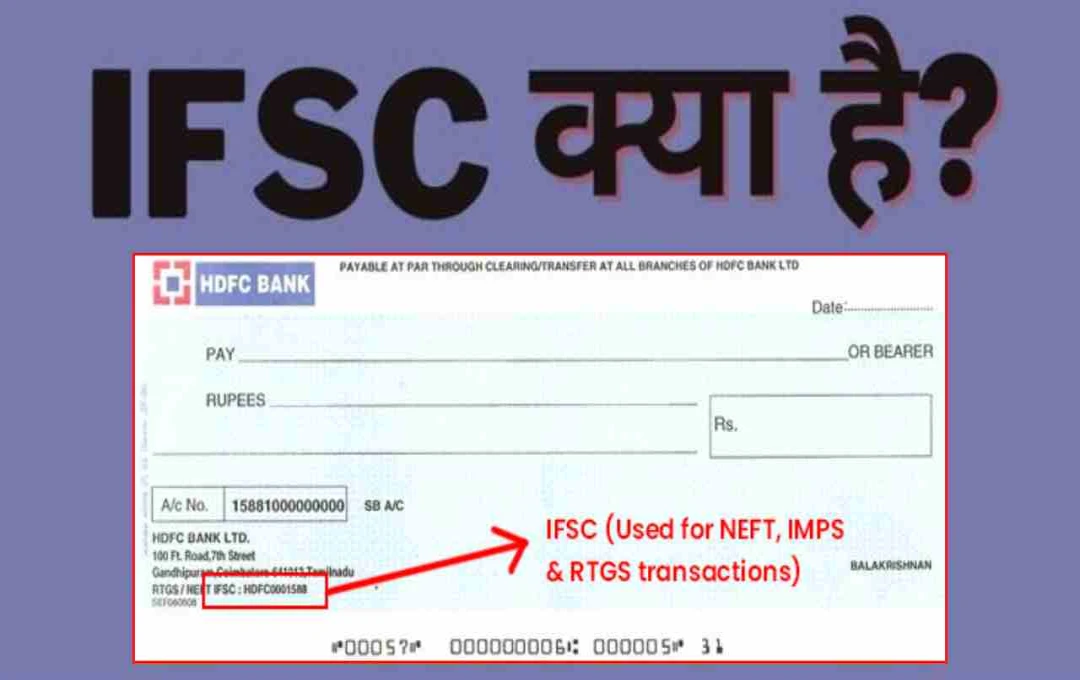

State Bank of India (SBI)'s market valuation increased by ₹19,589.54 crore, reaching ₹725,036.13 crore. Similarly, Bharti Airtel also performed exceptionally well, with its market capitalization rising by ₹14,084.20 crore to ₹1,058,766.92 crore. Furthermore, HDFC Bank's market value increased by ₹8,462.15 crore, reaching ₹1,489,185.62 crore. These figures indicate that some major companies in the financial sector maintain a b foothold in the market and remain trustworthy among investors.

Setback for Reliance and TCS Investors

While some companies showed growth, a decline in Reliance Industries Limited and TCS shares caused concern among investors. Reliance Industries' market capitalization fell by ₹7,645.85 crore, settling at ₹1,922,693.71 crore. TCS shares also dropped by ₹17,909.53 crore, reaching ₹1,253,486.42 crore.

The decline in these two companies is attributed to global market uncertainty, domestic economic challenges, and revenue pressure in the IT and energy sectors. Reliance's significant investments and fluctuations in crude oil prices may also have contributed to this downturn. For TCS, the situation includes global competition in the IT sector and a slowdown in some client projects.

Market Position of Other Companies

ICICI Bank, Bajaj Finance, Hindustan Unilever, and Infosys also registered declines this week. ICICI Bank's market capitalization decreased by ₹2,605.81 crore, reaching ₹1,031,262.20 crore. Bajaj Finance's market standing fell by ₹4,061.05 crore, settling at ₹570,146.49 crore.

Hindustan Unilever Limited's market value decreased by ₹1,973.66 crore to ₹552,001.22 crore, and Infosys's fell by ₹656.45 crore to ₹649,220.46 crore. This decline reflects the market's sluggishness and investor caution this week.

Stability in Top-10 Company Rankings

Reliance Industries maintained its top position in the Sensex's top 10 companies list. It was followed by HDFC Bank, TCS, Bharti Airtel, ICICI Bank, SBI, Infosys, LIC, Bajaj Finance, and Hindustan Unilever. These companies are considered b pillars of the Indian market, and their performance is closely watched by investors.