The Income Tax Department has extended the last date for filing ITR to September 15, 2025. The entire return process is now online, allowing taxpayers to conveniently complete it from home. This report provides a detailed procedure for ITR filing, a list of necessary documents, and a step-by-step guide from selecting the return form to verification.

Extended Deadline for Filing Returns

The Income Tax Department has provided significant relief to taxpayers in the non-audit category by extending the ITR filing deadline from July 31 to September 15, 2025. This decision considers changes in ITR forms, technical issues related to TDS, and taxpayer convenience.

Taxpayers now have an additional 45 days to file returns for the assessment year 2025-26. Filing a return is mandatory under the Income Tax Act, 1961, if a taxpayer's annual income exceeds the basic exemption limit.

Who Needs to File ITR?

If your annual income exceeds ₹2.5 lakh (for non-senior citizens) or you have undertaken specific financial transactions, filing an ITR is mandatory. Individuals with no taxable income but TDS deducted can also file an ITR to claim a refund.

Required Documents

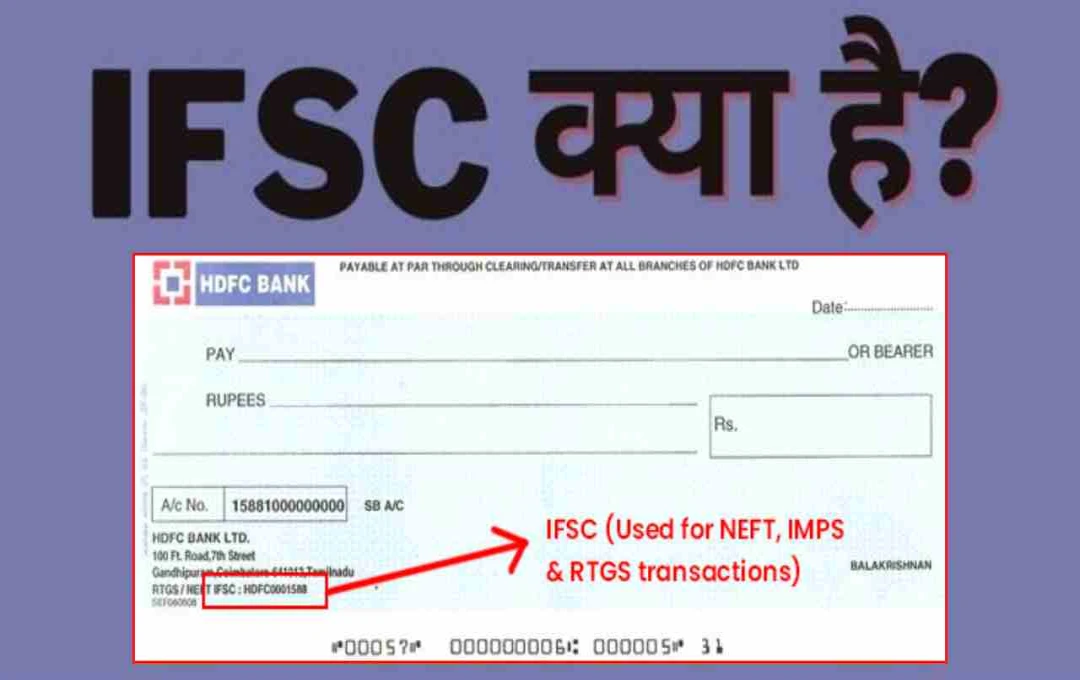

Keep the following documents ready before filing your ITR:

- Form 16 (for salaried individuals)

- Form 26AS (Tax Deduction Statement)

- Annual Information Statement (AIS)

- Tax Information Statement (TIS)

- Bank statement and interest certificate

- PAN and Aadhaar card

- Investment proofs (under Section 80C, 80D, etc.)

Companies typically issue Form 16 by the end of June or early July; therefore, salaried individuals may need to wait slightly.

How to Choose the ITR Form?

The Income Tax Department has released seven ITR forms (ITR-1 to ITR-7) for the financial year 2024-25:

- ITR-1 (Sahaj): For salary income, one house property, interest income, and total income up to ₹50 lakh.

- ITR-2: For more than one property, capital gains, or foreign income.

- ITR-3: For professionals or those with business income.

- ITR-4 (Sugam): For those opting for the presumptive income scheme.

- ITR-5 to ITR-7: For partnership firms, trusts, and companies.

Step-by-Step Online ITR Filing Process

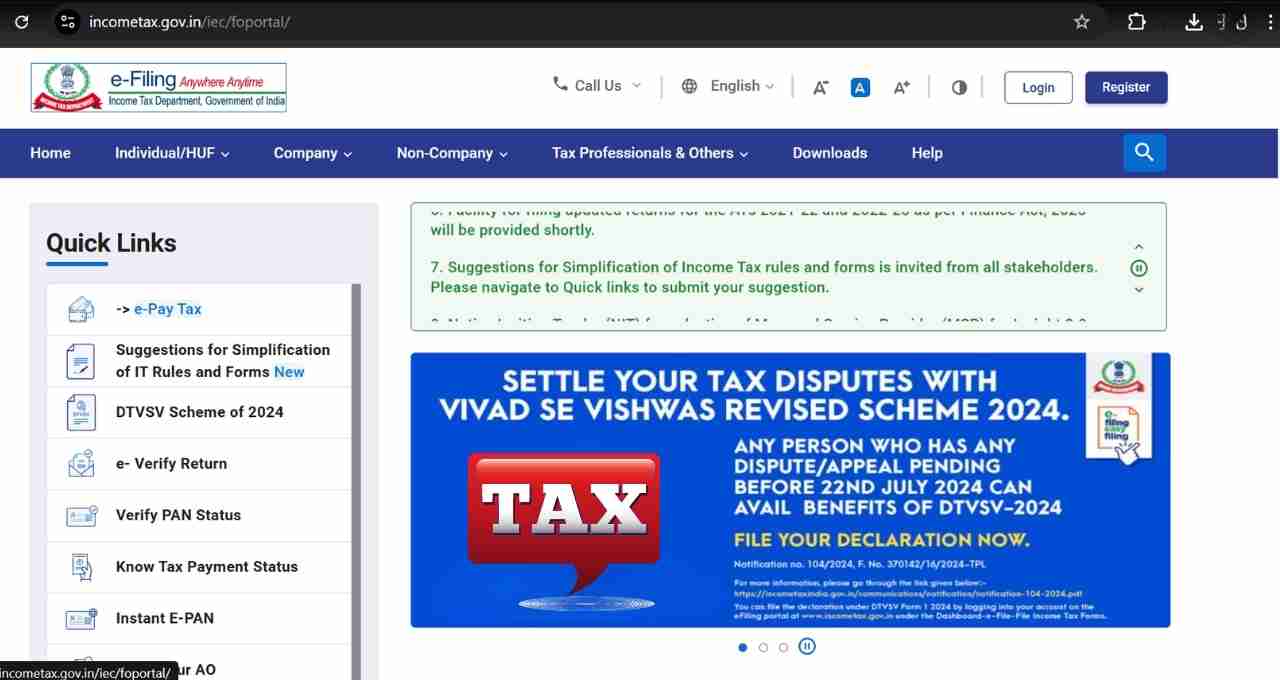

1. Login

- Go to https://www.incometax.gov.in

- Click on "Login"

- Enter your PAN as the user ID

- Login using your password and captcha.

2. Start ITR Filing

- Click on the "e-File" tab

- Select "Income Tax Returns" > "File Income Tax Return"

- Select AY 2025-26 as the assessment year

- Choose "Online" as the filing mode

- Select "Original" or "Revised" as the filing type

3. Select Status and Form

- Choose your status – Individual, HUF, or Others

- "Individual" is suitable for most individual taxpayers

- Select the correct ITR form based on your income source

4. Verify Information

- Check pre-filled data such as PAN, Aadhaar, name, address, and bank details

- Carefully verify information related to income, deductions, and exemptions

5. Verify Return

- You can choose Aadhaar OTP, Net Banking, or EVC for ITR verification.

- Alternatively, print, sign, and mail the ITR-V form to CPC, Bengaluru.