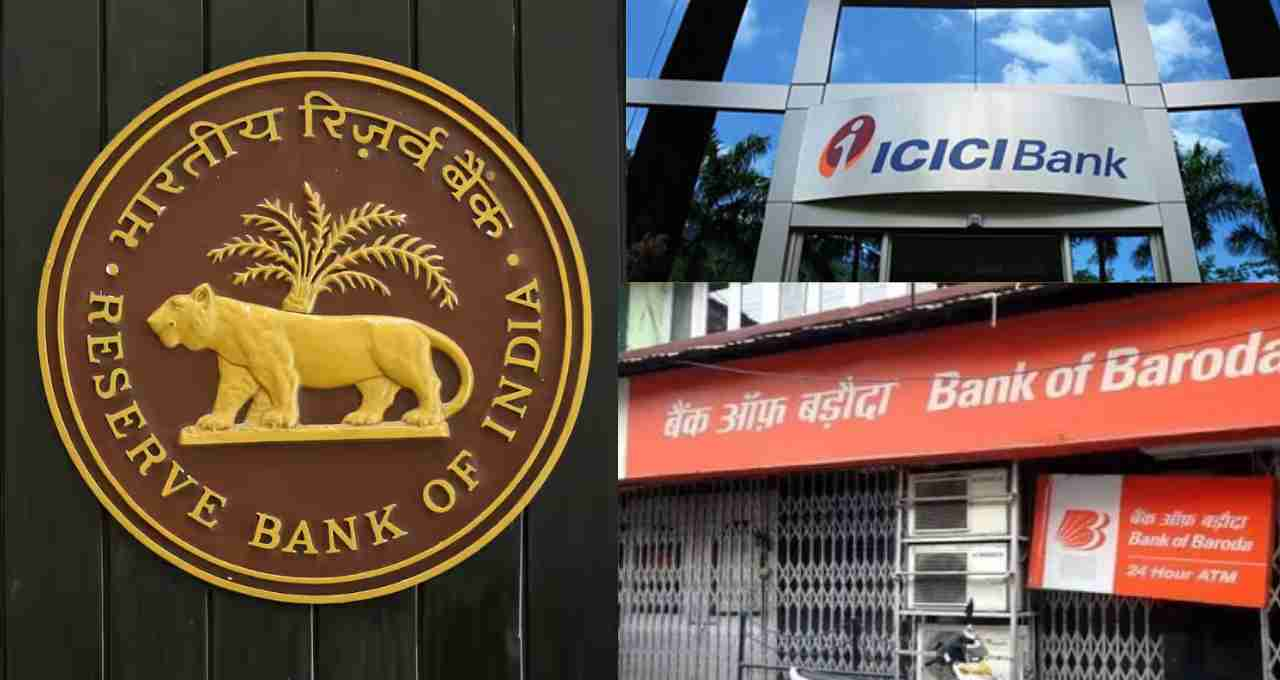

RBI Fines ICICI, Axis, IDBI, Bank of Baroda, and Bank of Maharashtra

The fines were levied for violations of cybersecurity, KYC, and other regulations.

RBI Action: The Reserve Bank of India (RBI) has imposed substantial fines on five major Indian banks: ICICI Bank, Axis Bank, IDBI Bank, Bank of Baroda, and Bank of Maharashtra. These penalties result from violations of banking regulations and non-compliance with directives. The following details the amount fined for each bank:

1. ICICI Bank fined ₹97.20 lakh

The RBI fined ICICI Bank ₹97.20 lakh for non-compliance with regulations related to cybersecurity frameworks, KYC (Know Your Customer), and credit-debit card rules.

2. Axis Bank fined ₹29.60 lakh

Axis Bank was fined ₹29.60 lakh by the RBI for non-compliance with directives regarding the unauthorized operation of branch accounts.

3. IDBI Bank fined ₹31.80 lakh

IDBI Bank received a ₹31.80 lakh fine from the RBI for violating directives related to interest subvention on short-term loans for agriculture and allied activities disbursed through Kisan Credit Cards.

4. Bank of Baroda fined ₹61.40 lakh

The RBI fined Bank of Baroda ₹61.40 lakh for non-compliance with issued directives regarding financial services and customer service counters.

5. Bank of Maharashtra fined ₹31.80 lakh

Bank of Maharashtra was fined ₹31.80 lakh by the RBI for non-compliance with KYC-related directives.

Will this affect your bank account?

If you are a customer of any of these banks, the fines will only impact the bank's internal processes, not your personal account operations. However, these events highlight the seriousness of banking regulations and the importance of their adherence.