The cost of education has significantly increased in recent times. Many families resort to education loans to finance their children's studies. However, if the parents have a history of loan defaults, will it affect their children's education loan applications? Let's understand this in simple terms.

What is a Default Status?

When an individual fails to repay their loan EMIs (Equated Monthly Installments) on time, banks classify them as defaulters. This indicates a failure to repay the debt properly. This negatively impacts the individual's credit score. A credit score is a numerical representation of an individual's creditworthiness, indicating their reliability in repaying loans. A poor credit score makes it difficult to obtain loans in the future.

Does Parental Default Status Affect Children's Education Loans?

Before approving an education loan, banks assess various factors, including:

- The nature of the student's course of study,

- The college or university where the course is being pursued,

- The student's future job prospects,

- And the parents' financial standing.

Many banks also consider the parents' credit score, especially when the parents are co-borrowers or guarantors. A poor credit score or a default status of the parents can make loan approval difficult or result in stricter lending conditions.

Situations Where Default Status Impacts Loan Approval:

- If parents are co-borrowers with a poor credit score, the bank will conduct a more thorough investigation and may increase the interest rate.

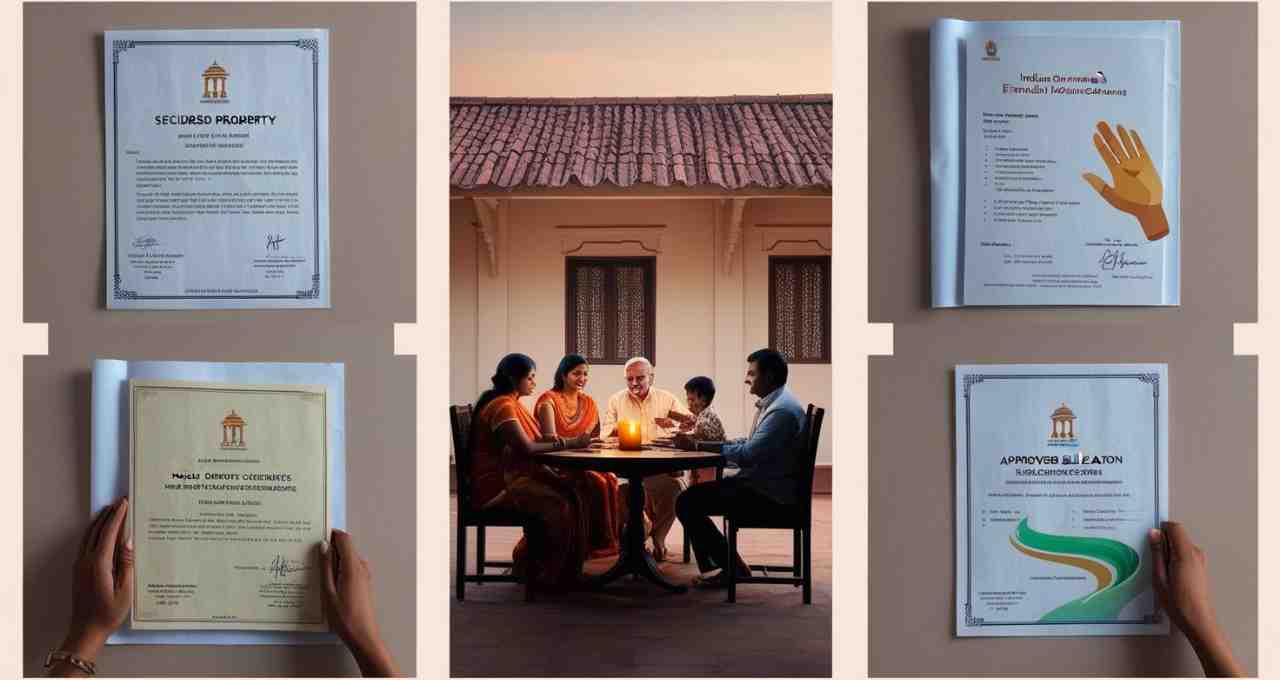

- When the loan is unsecured (without collateral), banks scrutinize the parents' credit score very carefully.

- If the loan is secured (with collateral), the impact of a default status is reduced as the bank's risk is minimized.

- If the student applies for the loan independently and has a good credit score, the parents' default status may not significantly matter.

Can Children Still Obtain Education Loans in Such Cases?

Yes, it is possible, but certain considerations are necessary:

- Choose the right co-borrower or guarantor: If the parents have a poor credit score, avoid making them guarantors. Consider other family members like uncles, older siblings, or others with good credit scores.

- Opt for a secured loan: Offering collateral (like a house or fixed deposit) significantly improves the chances of loan approval.

- Seek assistance from private lenders or NBFCs: Private banks and NBFCs (Non-Banking Financial Companies) may offer more flexibility than public sector banks, although interest rates might be slightly higher.

- Utilize government schemes: The government operates various education loan schemes such as the Central Sector Interest Subsidy Scheme and the Vidya Lakshmi Portal, which can provide assistance.

- Apply for smaller amounts: Some banks offer loans for smaller amounts without requiring a guarantor or collateral.

Parental default status can create challenges in obtaining an education loan, but with proper planning and exploring available options, securing a loan remains feasible. Remember to thoroughly research before applying for a loan and seek financial advice if necessary.