The Income Tax Department has already released all ITR forms for Assessment Year 2025-26, but the process isn't complete for salaried taxpayers. Salary earners might have to wait until mid-June to file their Income Tax Returns (ITRs), as most companies provide Form 16 around that time. Without Form 16, it's impossible to accurately fill in income, tax deducted, and other essential information.

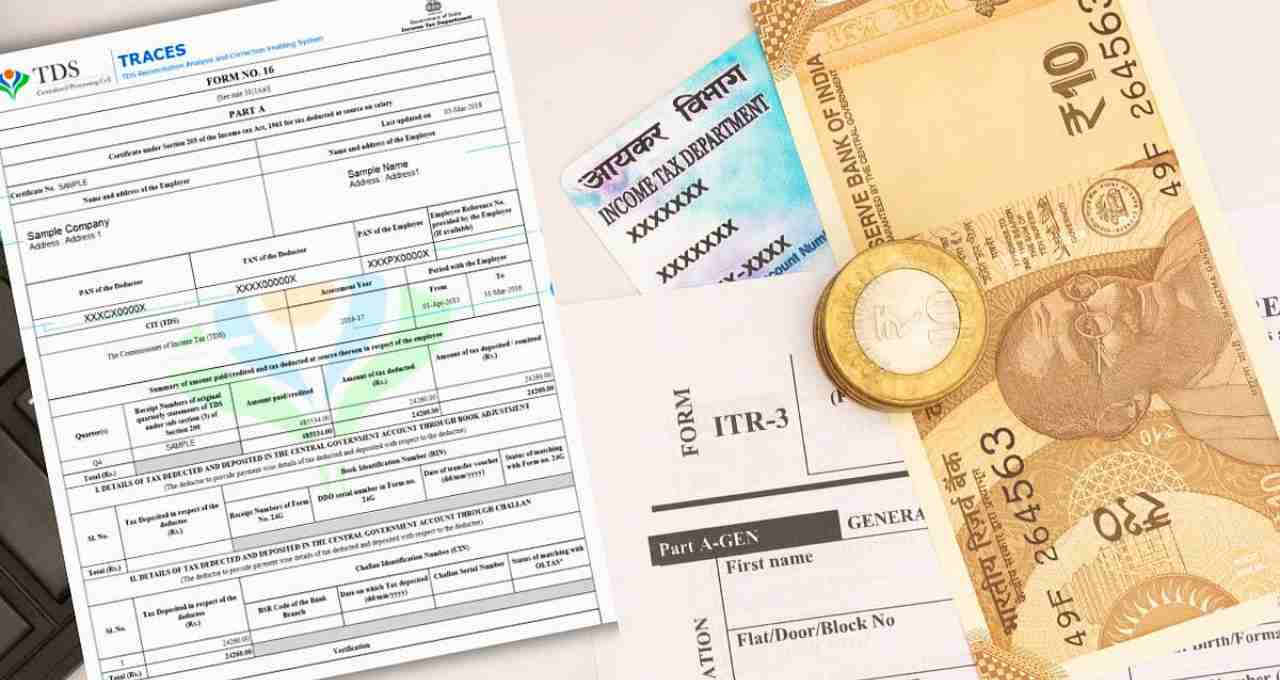

What is Form 16? Why is it crucial for salaried individuals?

Form 16 is a crucial document authorized by the Income Tax Department, especially necessary for salaried taxpayers. This document is issued by the employer and contains information about your annual salary income, tax deducted at source (TDS), and other tax-related details. Without Form 16, accurately filing an Income Tax Return becomes difficult, as it serves as official proof of your income and tax payments.

Complete Information on the Two Parts of Form 16

Form 16 is divided into two parts, each with a distinct role.

Part A:

This part contains basic information about the employer and employee, such as name, address, PAN (Permanent Account Number), and TAN (Tax Deduction and Collection Account Number). It also includes complete details of the tax (TDS) deducted from the employee's salary during that financial year. This part is generated from the TRACES portal and digitally verified.

Part B:

This is the detailed section of Form 16 prepared by the employer. It includes the breakdown of the employee's total salary, tax-related deductions like HRA (House Rent Allowance), LTA (Leave Travel Allowance), and details of deductions under sections 80C, 80D, etc., of the Income Tax Act.

If an employee has held more than one job in a financial year, each employer issues a separate Part A. If Form 16 is lost, the employee can obtain a duplicate Form 16 from their employer, which is perfectly valid.

ITR Filing Deadline and Why Waiting for the Right Time is Important?

The deadline for filing Income Tax Returns (ITRs) is generally July 31st, especially for taxpayers who don't require an audit. Timely ITR filing facilitates claiming refunds on excess tax paid and avoids penalties.

This year, the Income Tax Department has already released all forms, from ITR-1 to ITR-7, along with the ITR-V (verification) and acknowledgement forms. This will ease the process for those filing early.

However, salaried taxpayers may need to wait a while, as Form 16, crucial for their ITRs, is typically issued by mid-June. Without it, providing accurate income and tax deduction details can be challenging.

Furthermore, tax experts advise waiting for Form 26AS and AIS (Annual Information Statement) to be fully updated before filing ITRs to ensure data matching, avoid errors, and expedite processing.