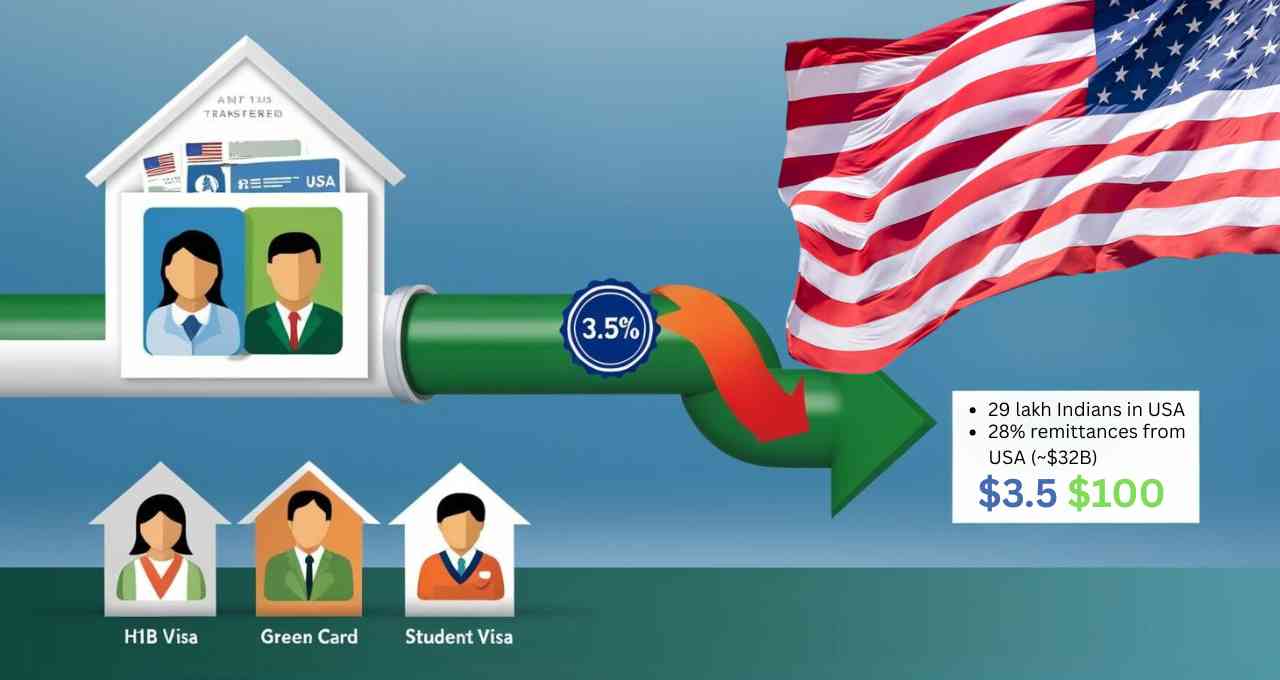

Sending money from the United States to India may soon become more expensive. A new provision in U.S. President Donald Trump's proposed "One Big Beautiful Bill" has sparked concerns among Indian immigrants. The bill includes a 3.5% tax on money transfers from the U.S. to India and other countries, starting in 2026. This is a reduction from the initially proposed 5% tax.

The bill has already passed the U.S. House of Representatives. It will now proceed to the Senate, where a vote is expected in June or July. If enacted, this legislation will significantly impact Indians residing in the United States.

Who Will Be Affected by the New Tax?

This new tax will not directly affect U.S. citizens. However, non-citizens, including H1B visa holders, green card holders, and those on student visas, will be subject to the 3.5% tax. With approximately 2.9 million Indians residing in the U.S., this regulation will particularly affect them.

Furthermore, remittances sent to India will be impacted. According to the Reserve Bank of India, approximately 28% of total remittances to India originate from the U.S., amounting to roughly $32 billion. If this tax is implemented, an additional $3.50 will be levied on every $100 transferred, increasing the cost of sending money to families in India.

Impact on NRE Accounts, Investments, and Companies

Experts suggest that the tax's impact will extend beyond simple money transfers, affecting investments in India such as NRE accounts and real estate. Individuals transferring funds from the sale of assets, stocks, or ESOPs in the U.S. to India will also be subject to the 3.5% tax. As this tax falls under 'excise tax', there will be no refund available under the India-U.S. tax treaty.

Moreover, this proposed tax will likely influence India-U.S. trade. Companies may need to incorporate this tax into their relocation packages for Indian employees sending portions of their salaries back to India, leading to increased costs for businesses.