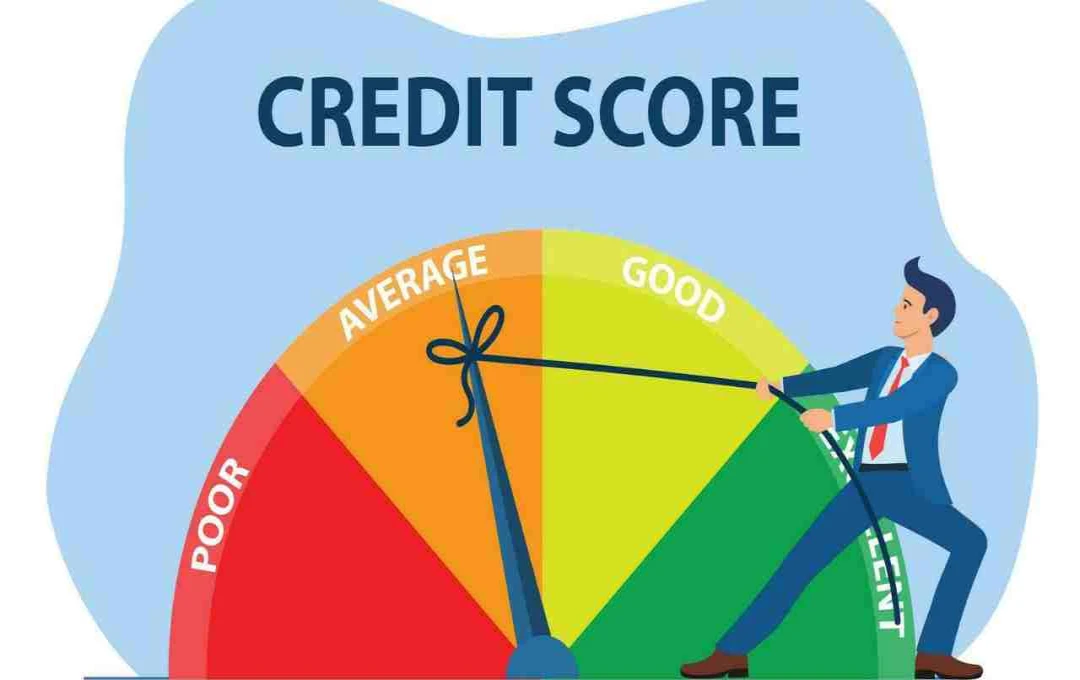

If your credit score has dropped without any clear reason, don't panic. Late payments, high credit utilization, or recent loan applications could be the cause. Improving your score is possible by making timely payments, limiting credit usage, and regularly checking your report.

Has your credit score suddenly decreased, and you can't understand why? Don't worry; this happens to many people. A credit score (CIBIL score) is a three-digit number indicating your creditworthiness in repaying loans or credit. This score ranges from 300 to 900—the higher the score, the better your creditworthiness.

A score decline can stem from various reasons, such as late payments, excessive credit card usage, or recently applying for multiple loans. Sometimes, minor issues significantly impact the score. For example, recently taking a new loan or exceeding your card's limit can lower your score. Let's explore the factors that can harm your credit score.

Payment Delays or Defaults

One of the most common reasons for a credit score drop is late payments. Approximately 35% of your score is based on your payment history. Even one late payment can affect your score, and delays of 60 to 90 days can severely impact it. Utilize options like auto-debit or reminders to ensure timely payments.

High Credit Utilization

The proportion of your credit card limit you utilize significantly impacts your score. Consistently spending close to your limit increases your credit utilization ratio, negatively affecting your score. Experts recommend keeping this ratio below 30% to protect your score.

Frequently Applying for New Credit

Applying for loans or credit cards multiple times within a short period can negatively impact your credit score. Each new credit application triggers a 'hard inquiry,' slightly lowering your score. While the effect isn't permanent, frequent applications can put pressure on your score.

Closing Old Credit Cards

Closing old credit cards without a compelling reason reduces your total credit limit, increasing your credit utilization ratio. It also affects your long credit history. If there are no significant fees and you use the card responsibly, keeping it open is advantageous.

Credit Limit Reduction

A reduction in your credit card limit may indicate poor credit behavior. This increases your utilization ratio and can lower your score. In such cases, request a limit increase from your bank.

Errors in Credit Report

Errors in your credit report—like reporting an incorrect payment default—can significantly affect your score. Carefully review your report and contact the relevant credit bureau to correct any inaccuracies.

Easy and Effective Steps to Improve Your Credit Score

- Ensure Timely Payments:

Pay all bills and EMIs on time. Setting up auto-debit or reminders can help prevent missed payments. - Avoid Unnecessary Credit Applications:

Refrain from applying for new credit cards or loans unless absolutely necessary. Frequent applications impact your score. - Pay Off Outstanding Debt Quickly:

Prioritize paying off any outstanding loans or credit card balances. This reduces credit utilization and improves your score. - Regularly Check Your Credit Report:

Identify and rectify any errors in your report promptly. This helps prevent unintentional score damage.