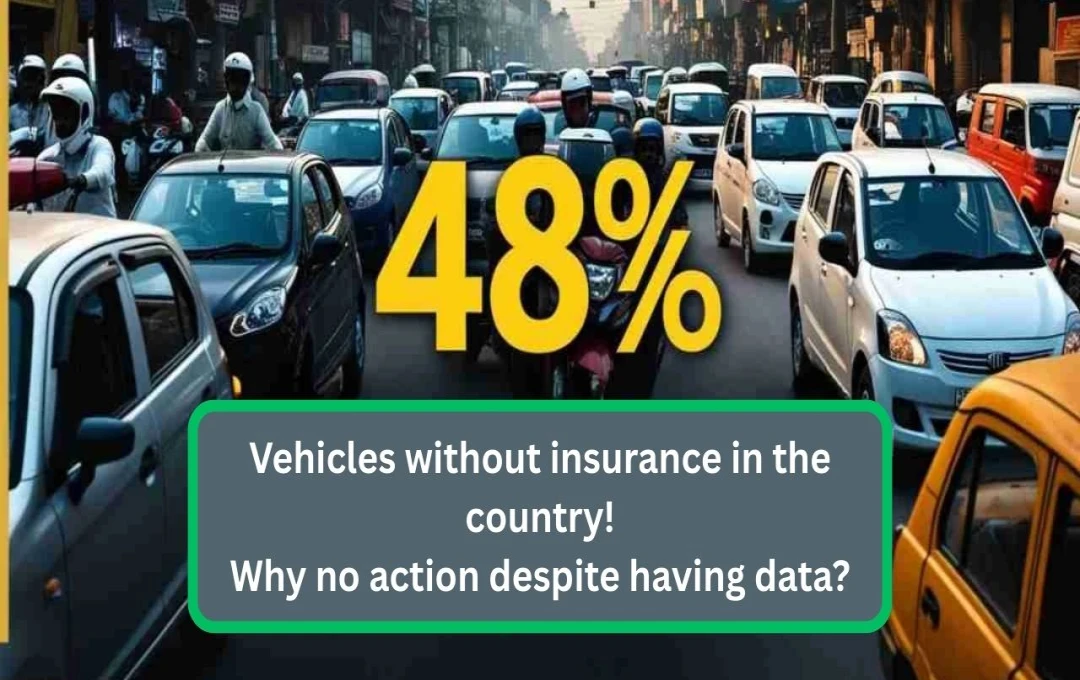

New Delhi, May 2025: A serious situation regarding motor insurance in India has come to light. Girija Subramanian, Chairperson and Managing Director of New India Assurance, revealed that only 52% of vehicles in the country are insured, meaning approximately 48% are operating without insurance. This is not only illegal but also complicates the process of providing compensation to victims of road accidents.

Why the lack of action despite available information?

According to Girija Subramanian, the government possesses comprehensive data on uninsured vehicles. Despite this, appropriate action is lacking due to a weak enforcement mechanism for insurance. This prevents those suffering losses in road accidents from receiving adequate assistance.

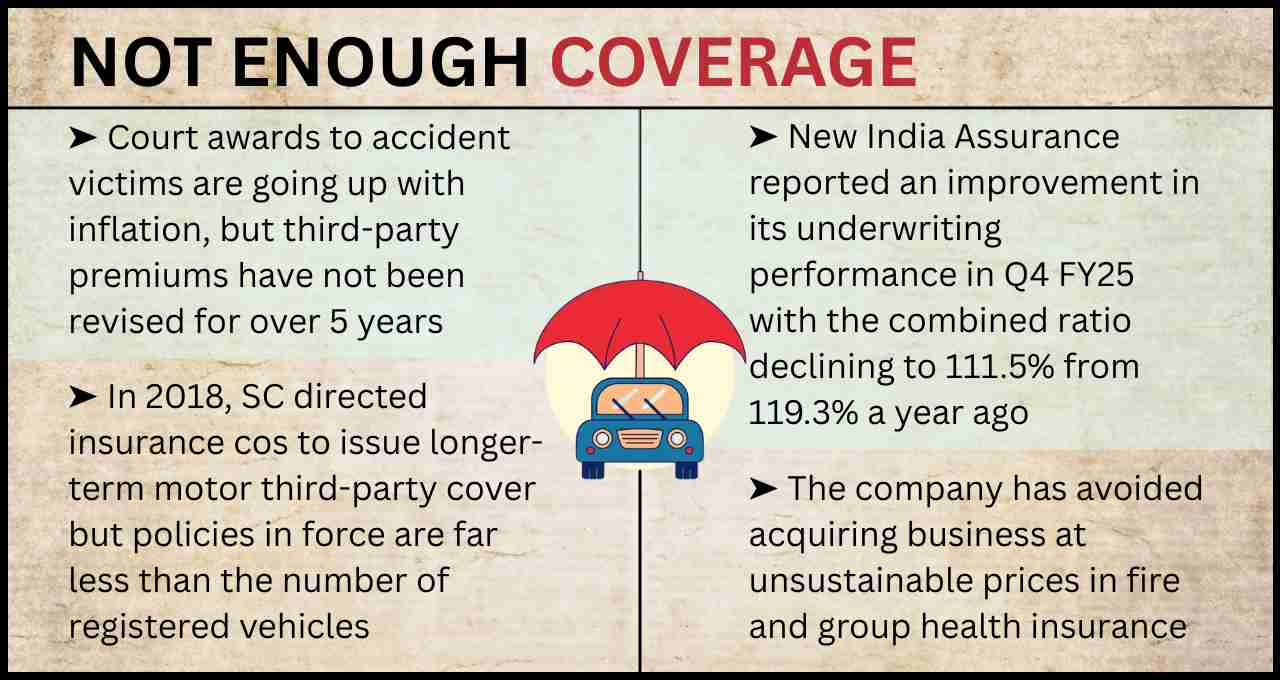

Need for an increase in insurance premiums

Third-party insurance premiums haven't been increased for several years, while court-awarded compensation amounts have risen over time. This is increasing the financial burden on insurance companies. Subramanian expects the Ministry of Road Transport and Highways (MoRTH) to revise premium rates this year.

Ignoring regulations remains a major challenge

In 2018, the Supreme Court and the Insurance Regulatory and Development Authority of India (IRDAI) clearly mandated three-year third-party insurance for new cars and five years for two-wheelers. Despite this, a significant gap exists between registered and insured vehicles. This clearly indicates inadequate enforcement of these regulations at the ground level.

Shift in insurance company strategy

New India Assurance currently focuses primarily on commercial vehicles, which have higher claim rates. The company now plans to expand into the private car and two-wheeler segments. Although commission costs are higher in these segments, the company will take concrete steps in this direction by 2026.

Expectations from digital platforms

The company is now partnering with digital platforms like PhonePe and other online aggregators to make insurance services more accessible. Furthermore, New India Assurance has invested in a new insurance marketplace called "Beema Sugam," where customers can compare various insurance options.

Strict enforcement is necessary

The shortcomings in vehicle insurance in India demand immediate improvement. Insurance data already exists; what is now needed is a robust monitoring and enforcement system to ensure compliance and provide timely assistance to people after road accidents.