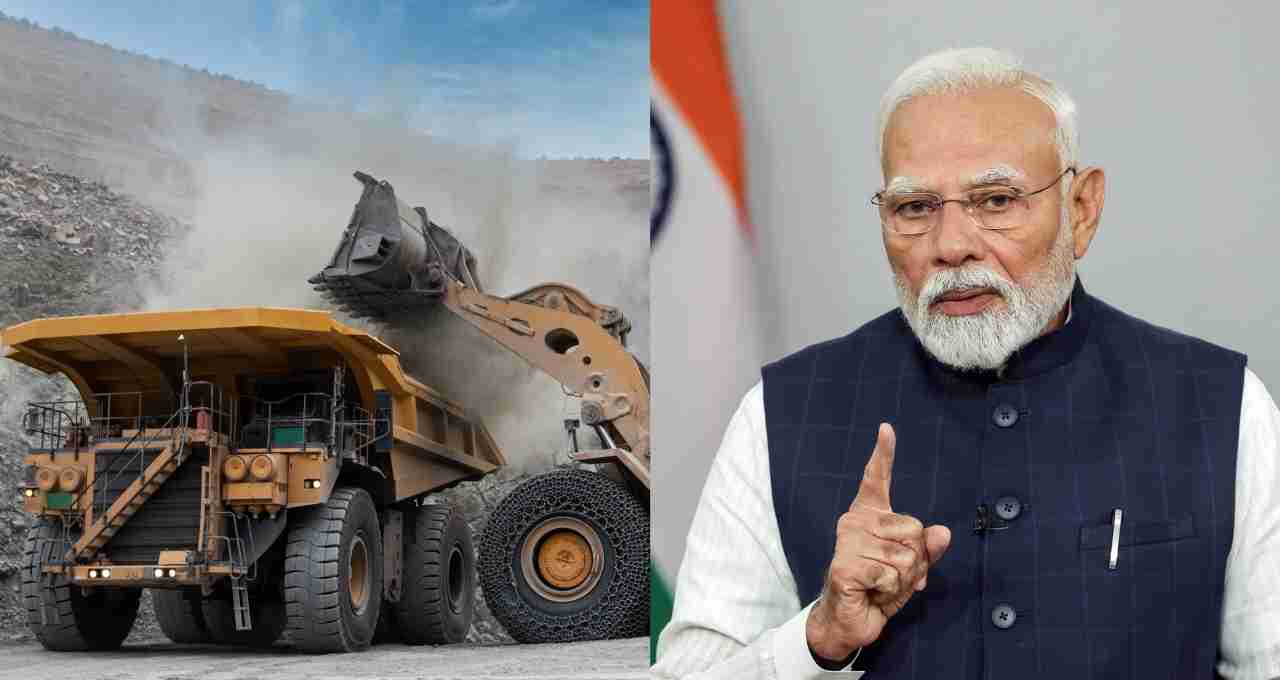

China has established such dominance in the rare earth elements (REE) trade that no other country in the world can compete.

One of the most significant shifts in the global minerals market over the past three decades has been China's unprecedented dominance in the rare earth elements (REE) sector. These 17 rare elements are essential in all modern technologies, from smartphones to missile systems. The question is: how did China become the undisputed leader in this field, and why are countries like India still struggling?

China's Control over Rare Earths

By 1995, China and the US had roughly equal REE production. However, by 2024, China's production had surpassed the US by six times. Furthermore, China has established a b grip on the entire global supply chain. From mining and processing to magnet manufacturing, China's control is firmly established at every level.

According to the US Geological Survey (USGS), China's rare earth production has increased ninefold over the past 30 years. Its share of global exports was 56.6 percent in 2012, reaching 63 percent by 2023. Countries like the US, India, and Japan now import over 80 percent of their rare earth products from China.

Government Subsidies and a Clever Pricing Strategy

A major reason for China's success is government incentives and planned policies. Chinese companies received substantial subsidies, enabling them to sell goods at significantly lower prices in the global market. This resulted in companies from countries like the US, Australia, and Japan becoming unable to compete and shutting down their mining operations.

The closure of the Mountain Pass Mine in the US in 2010 exemplifies this strategy. Following this, China further solidified its dominance and made global industries dependent on it.

India's Situation: Abundant Reserves, but Underutilized

India possesses vast reserves of rare earths. According to USGS data, India has reserves of approximately 6.9 million metric tons, placing it third globally. However, India's share in production and trade remains minimal. Between 2012 and 2023, India's total rare earth exports amounted to only $54 million, while China exported $763 million during the same period.

India's biggest challenge is the lack of technological and processing infrastructure. This is why India imports 96.9 percent of its total rare earth requirements from China. This dependence, which was 78.3 percent in 2012, has increased significantly.

The Global Impact of China's Recent Restrictions

In April 2024, citing national security concerns, China imposed stringent conditions on the export of rare earth magnets. Every export now requires detailed information, such as the destination, end-use, and often third-party testing.

The impact on the global supply chain was evident. Electric vehicle manufacturers like Tesla, Toyota, and BYD faced supply disruptions. The electronics sector saw production slowdowns for laptops and mobile phones. The defense sector, where these elements are used in missile guidance systems and radars, faced an even more significant crisis.

Options for India

India needs to wake up. If we want to utilize our vast reserves effectively, we must take strategic and concrete steps.

Investment in Mining and Processing

India must strengthen its domestic mining and processing capabilities. Currently, India lacks advanced processing technology and the necessary infrastructure. This requires joint investment from the government and the private sector.

Reducing Dependence on China

India must diversify its imports. Partnerships with countries like Australia, Canada, and Japan should be leveraged to develop alternative sources. Furthermore, India should enhance regional cooperation to establish itself as a ber player in the Asia-Pacific region.

Focus on Downstream Industries

Producing raw materials alone is insufficient. India must also expand into the manufacturing of rare earth magnets, motors, and other products. This will not only add value but also position India as a key part of the global supply chain.

Boosting Research and Development

Rare earth processing technology is highly complex. India must invest in research and development to create new, cost-effective, and environmentally friendly technologies. IITs and other technical institutions must be given priority encouragement in this area.

India's Position in Global Competition

Economies like Australia, Canada, and the US are attempting to challenge China's dominance globally. The US has restarted its Mountain Pass Mine and increased production, but China's dominance remains unchallenged.

This serves as a warning for India. If we do not act now, in the coming decades, we will remain merely a buyer, not a producer.