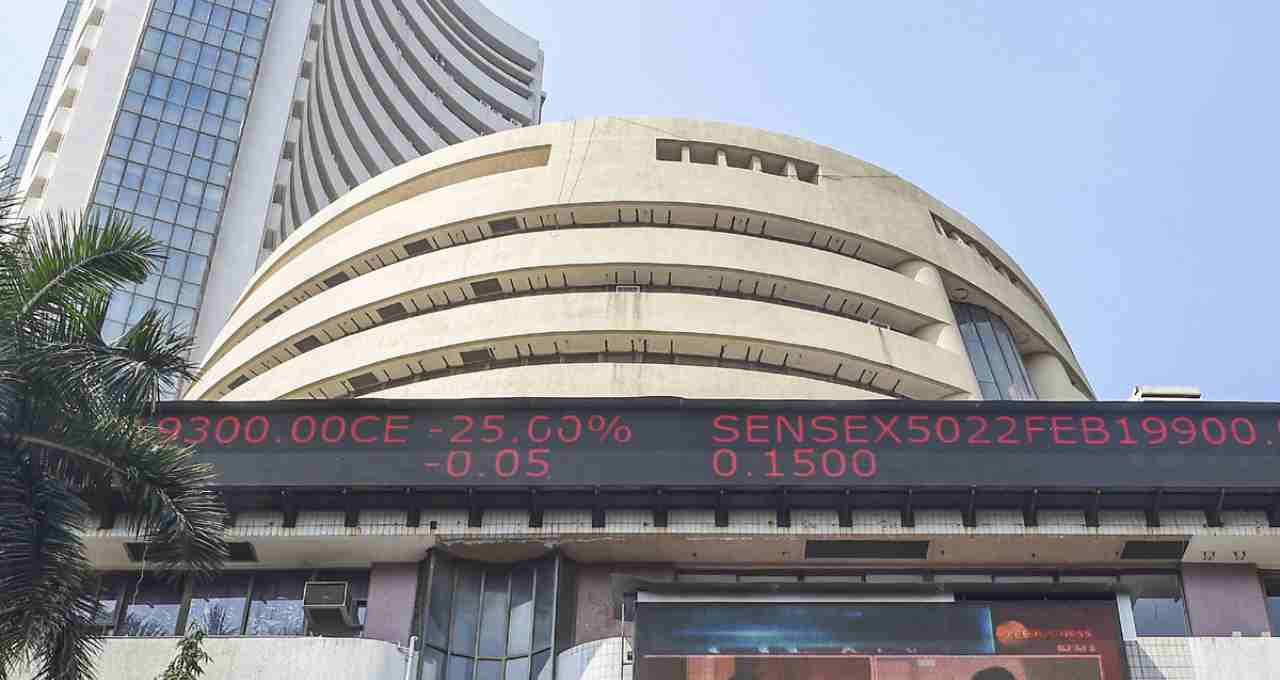

A recent BofA Securities survey reveals that India has emerged as the most preferred stock market in the Asia-Pacific region, surpassing major markets like Japan and China.

India has become the top choice for investors, leaving Japan behind. According to Bank of America's (BofA) latest fund manager survey, India has become Asia's most favored stock market, outperforming Japan. 42% of investors prioritized the Indian stock market in this survey, while 39% chose Japan.

Key reasons behind this surge are:

- The emerging supply chain in India following global tariff changes

- The realignment of investments post-COVID pandemic

Investor Focus on Two Key Sectors

The survey indicates that infrastructure and consumption are two key sectors attracting significant investor interest. However, 59% of investors believe the global economy might remain weak – a significant decrease from 82% last month. Concerns about weakness in Asian markets have also fallen to 77%, down from 89% previously.

Survey Participation

- This survey, conducted between May 2nd and 8th, 2025, involved a total of 208 global fund managers with a combined asset value of $522 billion.

- 174 managers (with a net worth of $458 billion) participated in the global segment.

- 109 managers (with a net worth of $234 billion) responded from the Asia Pacific regional segment.

The survey highlighted that only 6% of investors showed interest in the Chinese stock market, while Thailand showed the weakest performance.

Strong Recent Performance of the Indian Market

Over the past month, the Nifty 50 index outperformed all major Asian indices. The Sensex also saw a rise of 4000 points. Furthermore, b quarterly results from companies have boosted market confidence.

India Poised to Become the Fourth Largest Economy in 2025

An IMF report suggests that India could surpass Japan to become the world's fourth-largest economy by the end of 2025. This economic strength is driving increased foreign investment in India's equity market.